Now, let’s get stuck into the four different types of commercial property in Queensland you’ll need to know about on this investment journey.

The Ultimate Guide to Queensland Commercial Property Investing in 2026

- 18 min read

- February 12th, 2026

- Jacob Butler, Ernest Tong

This ultimate guide to commercial property investing in Queensland is designed for premium and experienced property investors who are looking to rely on tier-one research data to make their first (or next) commercial investment in the region.

By now, you probably have three or more assets in your portfolio. You may be a professional with a high income. Or, perhaps you have a large sum of superannuation, and you’re looking to secure cash flow in retirement.

If this is where you’re at, then read on.

Below is the exact data we’ve used to help commercial property investors in your position boost equity in their portfolios, enjoy high yields and maximise their cash flow.

If you’re looking for high-quality, data-driven analysis to help you make the decision about which commercial property investment market to choose next, then this is the article you need to read.

If you’re just starting your property investment journey, then we recommend you read our report on Residential Investing first.

Important – before continuing

Before you dive deep into the data, it’s vital to understand what you’re getting yourself into – especially if you’re relatively new to commercial property investing.

We’ve put together a ‘scorecard’ you can use when buying a commercial property to keep you out of danger and ensure a smooth investment.

Why smart investor money is flocking to commercial property in Queensland

The smart investors of Australia are increasingly turning to commercial property in Queensland due to a combination of strong macroeconomic and microeconomic factors.

The state’s regional markets in particular have become attractive because of their affordability and high yield potential, which gained prominence during the COVID-19 pandemic, when low interest rates encouraged first-time buyers.

This trend has since been amplified by significant population growth in Queensland, driven by people relocating to regional areas due to lockdowns and the rise of remote work.

As a result, investment activity in non-metropolitan regions has surged, with nearly $10 billion in transactions recorded by early 2023. Investors are targeting a variety of assets – including retail centres, industrial properties, pubs, motels, service stations and childcare centres – to meet the demands of this growing population.

The data shows people are moving to Queensland

Following Sydney and Melbourne, Brisbane has the third largest CBD district in the country.

It has a buzzing commercial market, with its property (especially that located in metro Brisbane) enjoying high rental growth in recent months.

This is largely due to the influx of residents (both national and international) and strong population growth driving consumer demand.

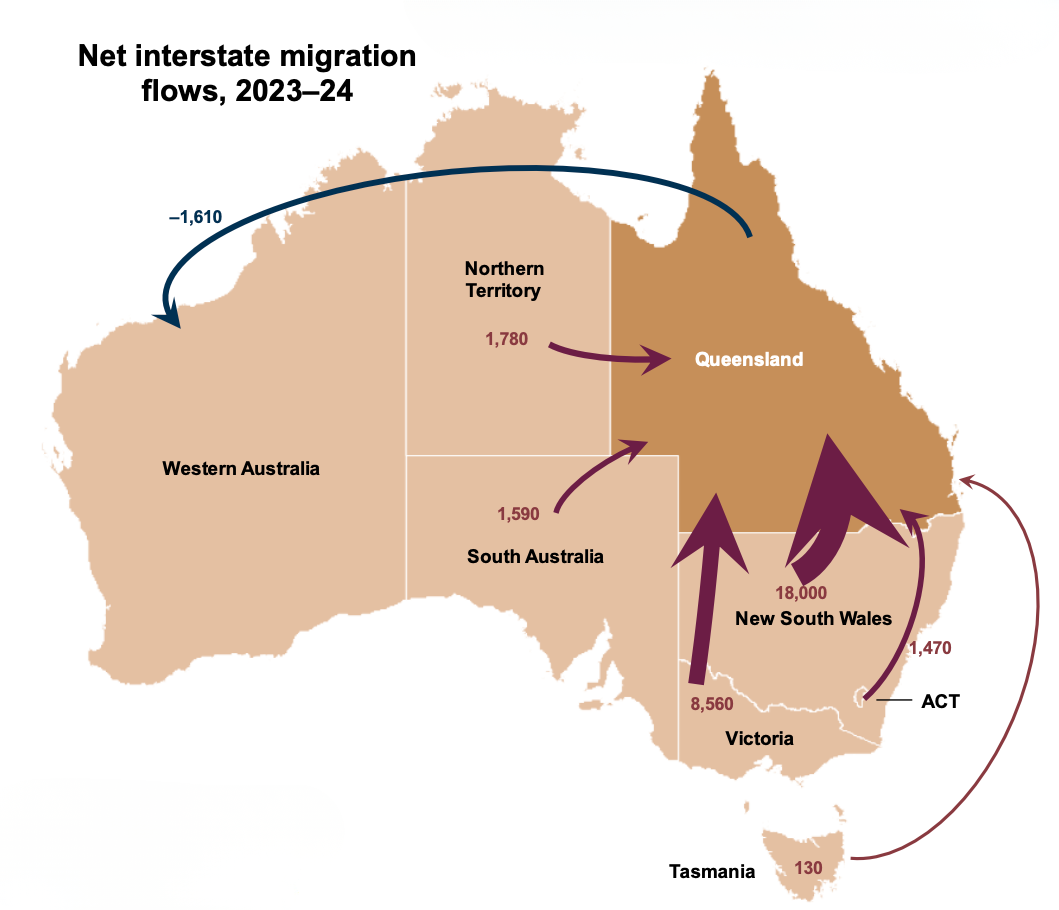

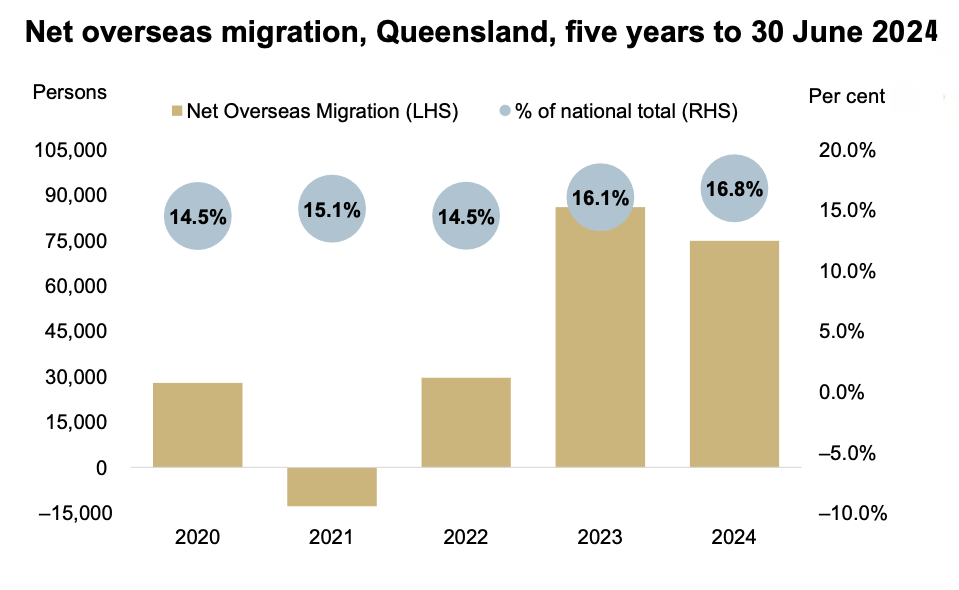

The above statistics published by the Queensland Government reveal a considerable increase in both interstate and international migration, especially in 2023.

This influx included a record net gain of 84,000 people from overseas in 2022–23 and 20,480 people flocking in from New South Wales in the same period.

We’ll break down the effects of this on the Queensland metropolitan market below.

The 6 pros of commercial property investing compared to residential property investing

There are scores of benefits to investing in commercial property as opposed to residential property.

-

Tenant pays most or all of your outgoings

In commercial property investing, tenants often cover the majority or even all of the property’s outgoings.

This includes things like council rates, property tax, maintenance costs and repairs, utilities and other expenses, such as insurance.

It is not uncommon for commercial tenants to sign so-called ‘triple net leases’, where the tenant is obligated to pay all of the abovementioned outgoings.These costs can escalate into the tens of thousands of dollars every year, so a solid lease can be considerably valuable and improve net profit for the investor.

-

Security of long-term leases

Commercial properties typically have longer lease terms compared to residential properties. They can span from 3 years to as long as 15 years and often include additional option(s) for lease renewal at the end of the term.

This provides investors with a stable and secure income stream and reduces the frequency of tenant turnover and associated costs.

-

Better-quality tenants

Commercial properties attract corporate tenants, who generally maintain the property well and are less likely to default on rent.

They have a reputation they need to uphold – not only to their landlord but also to their clients and the general public.

This higher calibre of tenants ensures the property remains in good condition and generates consistent income.

-

Guaranteed rental growth

Annual rent increases are typically included in commercial leases and are often linked to the Consumer Price Index (CPI) or fixed at an agreed rate between 2% and 5%. This guarantees rental growth over time.

Data released by the Australian Bureau of Statistics in 2025 illustrates how CPI rents across Australian capital cities have increased over the past decade, with Brisbane leading the way.

This automatic rent escalation helps protect against inflation and ensures the property’s income keeps pace with rising costs.

-

Capital growth potential

The income growth from rental increases directly contributes to the capital growth potential of the commercial property.

As the asset generates more income, its market value is likely to rise, offering investors the opportunity for significant capital appreciation.

-

Tax benefits

Commercial property investments come with various tax advantages, such as depreciation benefits and deductions on interest and expenses.

These tax benefits can enhance the overall return on investment, making commercial property an attractive option for investors.

The 2 cons of commercial property investing compared to residential property investing

Like all investing, commercial property investing still has its share of risks and challenges.

Ultimately, it is a more complex venture compared to residential property investing.

-

Potential for longer vacancy periods

One of the primary cons is the potential for longer vacancy periods, especially if the property is in a less desirable location or caters to a niche market.

This can significantly impact cash flow, as commercial properties typically rely on long-term leases with businesses, which may take time to secure.

In Queensland, however, there may be less of a need to worry about this. We have seen Brisbane’s overall CBD vacancy rate fall in the most recent quarter (Q2, 2024), from 11.7% to 9.5% (source: Property Council of Australia).

This is considerable – as it signifies Brisbane’s lowest office vacancy rate in over 10 years.

-

Higher cost of entry

When it comes to commercial investments, the cost of entry is usually higher.

Lenders will generally require you to put down a larger deposit – often around 30% – to obtain financing, making it less accessible to some investors. (Residential properties only require 5%–10% deposits.)This, coupled with more stringent lending policies, can limit opportunities and increase financial risk.

Want to ensure you’re making a smart choice when buying a commercial investment property?

We’ve put together a Commercial Property Investing Scorecard specially designed for commercial investors. This scorecard will help you check off everything you need to do during the purchasing process. You can download the scorecard here.

Download the Gather Commercial Property Investment Scorecard hereThe 4 distinct key types of commercial property in Queensland

Many investors (not saying this is you) treat ‘commercial property’ as a homogenous blob.

But not all commercial property is the same – so let’s break down the differences (and why they matter).

-

Retail

Retail properties encompass spaces designed for businesses that sell goods and services directly to consumers. This category includes shopping malls, strip malls and standalone stores.

Example: The Queen Street Mall and James Street Precinct in Brisbane are prominent examples, hosting a variety of retail outlets from high-end fashion stores to casual dining options, making it a central hub for shopping and entertainment.

Recent retail data: Retail rents increased across all retail categories in Q4 of 2025, primarily driven by limited new supply. In particular, neighbourhood centres in Brisbane enjoyed strong rental growth, increasing by 1.1% quarter-on-quarter and 3.3% year-on-year to $994/sqm (source: CBRE Brisbane Retail Figures, Q4 2025).

This is supported by ongoing investment into Queensland’s capital because of the Olympics, with Queensland infrastructure spend has increased more than three-fold over the past decade, with investment expected to total $27 billion in 2025. This includes the $6.3 billion Cross River Rail due for completion in 2025 and a $7.1 billion Olympic infrastructure plan for Southeast Queensland.

-

Industrial

Industrial properties are used for manufacturing, warehousing and distribution.

These buildings are typically located in areas with easy access to transportation routes.

Example: The Yatala Enterprise Area in South East Queensland is the largest industrial area on the Gold Coast. The area features large warehouses, manufacturing plants and distribution centres that serve various industries across the region.

Recent industrial data: Across all eastern seaboard cities, Brisbane has enjoyed the strongest tenant activity in industrial markets, rising by 7% year-on-year in 2024, 9% above the 5-year average (source: Knight Frank Research, Q4 2024 / Q1 2025 ). Vacancy sat at 3.7% in Q3 2025 (down from 4.2% in Q2), with prime net rental growth of 6.2% year-on-year.

-

Office

Office properties – surprise, surprise – refer to rooms in buildings designed for businesses, professional services and administrative work.

These properties can range from high-rise buildings in central business districts to suburban office parks.

Example: The Riverside Centre in Brisbane is a landmark office property that houses numerous corporate headquarters and professional services firms.

Recent office data: According to recent data published by KPMG in December 2025, Brisbane CBD delivered the strongest total returns nationally at 6.8%. Brisbane prime yields sit at around 7.25%, compared to Sydney at approximately 6.03% and Melbourne at approximately 6.4%, representing a spread of 120–125 basis points over Sydney.

-

Specialty

Specialty commercial properties cater to specific uses and markets and include everything from childcare centres to service stations and hotels.

Now that we’ve covered all the bases, it’s time to get into the specifics – here are the risk profiles for the two types of commercial property markets in Queensland.

Metro and Regional Commercial Property Investing in Queensland

Let’s explore the metro and regional Queensland commercial property investment markets.

The Metro Queensland Commercial Markets

Brisbane Metro North and South

Key locations: CBD, Spring Hill, Fortitude Valley, Newstead, Milton, South Brisbane, Upper Mount Gravatt, Eight Mile Plains

Driving growth factors: Population growth, immigration, infrastructure development (for example, Olympics investment), limited supply

Logan Corridor

Driving growth factors: Close proximity to Brisbane, infrastructure development, lifestyle, affordability

The City of Logan is located in the thriving South East Queensland region – and strategically positioned between Brisbane and the Gold Coast.

This prime location allows Logan to serve as a crucial link between the two dynamic economic centres that make Queensland, well, Queensland!

The city is at the heart of South East Queensland’s primary transport corridor, one of Australia's key economic routes – and therefore a terrific location for property investment. The population in this area is steadily rising, predicted to grow 50% to around 548,000 in 20 years (source: Logan Office of Economic Development).

Logan’s development is playing a vital role in the fulfilment of Queensland’s long-term South East Queensland Regional Plan, which identifies infrastructure investment within Logan as essential to providing improved freight accessibility to the Park Ridge and Crestmead/Berrinba industrial areas.

Gold Coast

Key locations: Bundall, Robina, Southport, Surfers Paradise, Burleigh Heads, Broadbeach

Driving growth factors: Population growth, tourism, affordability, infrastructure investments (for example, the Cross River Rail project)

The Gold Coast is next on the list – the hub of tourism, beautiful beaches and all-round fun.

But when it comes to commercial real estate, things start to get serious.

Investing in commercial property on the Gold Coast is a strategic move given the area’s status as a major economic and tourism epicentre of Australia.

The region's steady economic growth, growing population and diverse industries provide a strong foundation for various commercial ventures, ensuring long-term viability and success.

Office rents have accelerated sharply, with A/B grade face rents climbing more than 10% in 2024 alone, far exceeding the cumulative 8.1% growth recorded over the preceding three years from 2020 to 2023 (source: CBRE Gold Coast Research, February 2025).

(Source: PCA Office Market Report, July 2025)

The region’s population has been growing strongly at around 2.3% per annum, with actual growth running ahead of projections – McCrindle forecasts the Gold Coast will reach 1 million residents by 2034, well ahead of earlier estimates of 2046.

Commercial transaction activity on the Gold Coast has recovered strongly, supported by institutional investors increasingly pivoting from capital city CBD markets to regional markets with tighter vacancy and stronger demand fundamentals (source: LJ Hooker Commercial Gold Coast Market Monitor, 2024).

Sunshine Coast

Key locations: Maroochydore, Sippy Downs, Caloundra, Palmview, Nambour, Hinterland

Driving growth factors: Massive infrastructure investment, influx of high-income residents, diverse job opportunities, ongoing migration

The Sunshine Coast is one of the strongest commercial office and industrial markets in Australia.

The industrial market specifically enjoyed a massive 62% spike in rents from January 2021 to early 2024, as can be seen from the below graph.

There’s so much going for the Sunshine Coast that it’s obvious why the region made the list:

- Maroochydore is set to become Australia’s newest greenfield CBD, featuring 160,000 m2 of commercial and retail space.

- Caloundra (the ‘City of Beaches’) Is undergoing a large revitalisation, including a major overhaul of the Events Centre and planning for a town square development.

- Palmview is a $4 billion master-planned community that will be completed over the next two decades, creating opportunities for shops, small businesses and professional services companies.

Unsure about what to specifically look for in this market?

We understand the whole process can be overwhelming.

That’s exactly why we’ve put together a Commercial Property Investing Scorecard to help rate your investment based on our criteria for asset selection.

Now that you know about metro Queensland’s commercial markets, it’s time to start exploring regional Queensland’s markets – which have their own unique set of benefits.

The Regional Queensland Commercial Markets

Regional Queensland is a stunning part of Australia – there’s no question about it.

Pristine beaches. Lush rainforests. Rugged outback terrain. Charming country towns.

The area is a tourist’s paradise – and it’s also a place that savvy commercial property investors should keep an eye on.

The area's growing population, driven by lifestyle changes and an increased interest in regional living, has spurred demand for businesses and services.

Towns like Cairns, Townsville and Rockhampton are not only pretty places to visit – they’re also experiencing economic growth, supported by industries such as tourism, agriculture and mining.

Here are the five suburbs we think you should be watching closely.

Townsville

Driving growth factors: Growing economy diversity, increasing population, growing employment

Townsville’s commercial property market presents an excellent opportunity for investors to make key decisions that grow their portfolio.

The suburb has enjoyed a significant economic boom over the most recent years, especially in critical minerals, renewals and logistics – translating into a stronger demand for commercial property.

Townsville’s population has spiked by 161% over the past 25 years, with the highest commercial sale rising by 720% from $18.33 million to $132 million over the same time period (source: Knight Frank Research, 2023).

Cairns

Driving growth factors: Diverse economy, strong employment, tourism

The Cairns commercial property investment market is confident.

The suburb’s population has steadily increased over the past 10 years, commercial property is twice cheaper than that in the more expensive cities, and it’s home to Australia’s busiest regional airport (source: Cairns Regional Council, 2024).

Toowoomba

Driving growth factors: Government investment in infrastructure, population growth, economic diversity

Largely thanks to government investment in infrastructure, Toowoomba has become one of Queensland’s most attractive commercial property markets.

It has now reached the point where commercial investors in Sydney and Melbourne are keeping a close eye on the Toowoomba and Darling Downs areas.

Over the past decade, infrastructure projects such as the Second Range Crossing and the Wellcamp Airport have allowed businesses to operate more efficiently and investors are taking notice.

Other projects, such as the Toowoomba North–South Transport Corridor and the Inland Rail, are expected to present considerable opportunities for business, with the Inland Rail alone expected to facilitate a 75% increase in freight over the next 10 years.

Bundaberg

Driving growth factors: Population growth, growing investments, thriving job market, affordable lifestyle

Next on the list is Bundaberg, located about 385 kilometres north of Brisbane.

In 2023, this regional location was reported to have grown by 7.1% – experiencing the second highest economic growth rate of the major Queensland regional centres for the second year in a row (source: National Institute of Economic and Industry Research, 2023).

NIEIR statistics also reveal that industry gross regional production in Bundaberg has been steadily increasing over time.

The suburb is known for several iconic companies, from Bundaberg Run and Macadamias Australia to Farmfresh Fine Foods.

Mackay

Driving growth factors: Strong resources sector, growing agribusiness industry, tourism, health, logistics, education, construction

Last, but certainly not least, we have Mackay – a regional centre known for its robust economy, with growth in the tourism, agriculture and mining sectors.

The centre is home to incredible coal deposits in the Bowen and Galilee Basins, and it also boasts one of Australia’s leading sugar-producing regions.

With a population of over 125,000, the suburb supports 55,000 jobs and enjoys an annual economic output of around $22.3 billion (Mackay Regional Council, 2023).

Not sure about how to navigate a regional investment?

We’ve put together a scorecard to help you manage a successful commercial investment property purchase, perfect for use when choosing the right property.

Download the Gather Commercial Property ScorecardWhat your budget affords you in Queensland – broken down by 4 key price brackets

We completely understand that in this day and age, sticking to a budget as a commercial investor is your priority.

So, we’ve broken down the different commercial assets your budget can get you and separated them into four key price brackets.

Price bracket 1: sub $1 million

Investment Spotlight: Metro Queensland Retail Property

Type

Retail – single strata

Location

Capital city centre, premium position

Tenant Profile

Skincare clinic

Lease Terms

- New lease to March 2027 with a 3-year renewal option

- 4% annual rent increases

Key Property Features

- Size: 40 m² with 1 basement carpark

- Building Details: Ground floor office / retail tenancy

Purchase Details

- Purchase Price: $348,888

- Deposit: 30% ($104,666)

- Loan Amount: 70% ($244,222)

Additional Costs

- Stamp Duty: $10,636

- Building and Pest Report: $500

- Valuation: $2,000

- Solicitor Costs: $5,000

Total Investment: $367,024

Total Cash Required: $122,802

Net Returns

- Net Annual Income: $19,665

- Net Yield: 5.64%

Cash-on-Cash Returns

- Loan Costs: $15,874 annually (at 6.5% p.a. on 70% debt)

- Return on Equity (After Loan Repayments): 3.09%

- Return on Equity with Growth Assumptions:

- 5% Capital Growth Rate: 17.29%

- 8% Capital Growth Rate: 25.82%

This property offers a strong rental yield, attractive growth potential and a secure long-term lease, making it a compelling option for investors.

Price bracket 2: $1 million – $2 million

Investment Spotlight: Regional Queensland Industrial Property

.png?width=427&height=289&name=image0%201%20(1).png)

.png?width=427&height=289&name=image0%201%20(2).png)

.png?width=427&height=289&name=image0%201%20(2).png)

Type

Industrial – multiple freestanding sheds

Location

Regional agricultural town

Tenant Profile

Long-standing tenants, fully leased

Building Features

- Metal-clad construction

- CPI annual rent increases

Key Property Features

- Size: 2,587 m² building area on 8,257 m² land

Purchase Details

- Purchase Price: $1,875,000

- Deposit: 30% ($562,500)

- Loan Amount: 70% ($1,312,500)

Additional Costs

- Stamp Duty: $88,338

- Building and Pest Report: $1,000

- Valuation: $3,500

- Solicitor Costs: $6,500

Total Investment: $1,974,338

Total Cash Required: $661,838

Net Returns

- Net Annual Income: $145,740

- Net Yield: 7.77%

Cash-on-Cash Returns

- Loan Costs: $85,313 annually (at 6.5% p.a. on 70% debt)

- Return on Equity (After Loan Repayments): 9.13%

- Return on Equity with Growth Assumptions:

- 5% Capital Growth Rate: 23.30%

- 8% Capital Growth Rate: 31.79%

This property offers a stable income stream with fully leased sheds, strong tenant longevity and a high-yield return – ideal for investors looking to diversify into commercial property.

Price bracket 3: $2 million – $5 million

Investment Spotlight: Regional Queensland Industrial Office/Warehouse

.png?width=428&height=289&name=image0%201%20(3).png)

.png?width=428&height=289&name=image0%201%20(4).png)

.png?width=428&height=289&name=image0%201%20(5).png)

.png?width=428&height=289&name=image0%201%20(4).png)

.png?width=428&height=289&name=image0%201%20(3).png)

.png?width=428&height=289&name=image0%201%20(5).png)

Type

Industrial – freestanding office/warehouse

Location

Regional industrial hub

Tenant Profile

Leased by NDIS provider

Lease Terms

Leased to 2027 with 2× 5-year renewal options

Key Property Features

- Size: 1,564 m² building area on 3,720 m² land

- Features: Fully converted to office space

Purchase Details

- Purchase Price: $2,980,000

- Deposit: 30% ($894,000)

- Loan Amount: 70% ($2,086,000)

Additional Costs

- Stamp Duty: $151,875

- Building and Pest Report: $1,500

- Valuation: $5,000

- Solicitor Costs: $9,000

Total Investment: $3,147,375

Total Cash Required: $1,061,375

Net Returns

- Net Annual Income: $237,790

- Net Yield: 7.98%

Cash-on-Cash Returns

- Loan Costs: $135,590 annually (at 6.5% p.a. on 70% debt)

- Return on Equity (After Loan Repayments): 9.63%

- Return on Equity with Growth Assumptions:

- 5% Capital Growth Rate: 23.67%

- 8% Capital Growth Rate: 32.09%

This property is a standout opportunity for investors seeking strong regional industrial exposure, long-term lease security and robust rental income with exceptional growth potential.

Price bracket 4: $5+ million

Investment Spotlight: Metro Queensland Medical and Consulting Property

.png?width=427&height=289&name=image0%201%20(6).png)

.png?width=427&height=289&name=image0%201%20(7).png)

.png?width=427&height=289&name=image0%201%20(8).png)

.png?width=427&height=289&name=image0%201%20(7).png)

.png?width=427&height=289&name=image0%201%20(6).png)

.png?width=427&height=289&name=image0%201%20(8).png)

Type

Medical and consulting – multi-tenanted freestanding

Location

Metro suburb, approximately 13 km from Brisbane

Tenant Profile

Purpose-built medical centre

Lease Terms

- Completed in 2003

- 8.25-year WALE

- CPI or 3% annual rent increase

Key Property Features

- Size: 955 m² building area on 4,109 m² land

Purchase Details

- Purchase Price: $8,544,000

- Deposit: 30% ($2,563,200)

- Loan Amount: 70% ($5,980,800)

Additional Costs

- Stamp Duty: $471,805

- Building and Pest Report: $2,500

- Valuation: $6,000

- Solicitor Costs: $12,000

Total Investment: $9,036,305

Total Cash Required: $3,055,505

Net Returns

- Net Annual Income: $538,317

- Net Yield: 6.30%

Cash-on-Cash Returns

- Loan Costs: $388,752 annually (at 6.5% p.a. on 70% debt)

- Return on Equity (After Loan Repayments): 4.90%

- Return on Equity with Growth Assumptions:

- 5% Capital Growth Rate: 18.88%

- 8% Capital Growth Rate: 27.27%

This premium asset combines stable income, an excellent tenant profile and long-term growth potential in a sought-after Brisbane metro location, making it an exceptional investment opportunity.

Where to From Here?

There’s no easy way to build a strong and scalable commercial property portfolio.

But, hopefully, with the guidance and data we’ve provided in this article, you’ll be able to come up with a strategy to build your empire in Queensland – whether that’s in metro, regional or both.

The markets we’ve identified in this article can help you build a solid foundation in Queensland and fast-track you towards your property goals.

All you have to do now is make a decision.

Would You Like Our Help?

If you’d like to join our waiting list and become a private client of GATHER, we invite you to click the button below and complete a short form.

As we are a boutique buyer agency for investors, we GATHER property specifically for you and your brief – unlike some of the other buyer agency services, which are more like property matchmakers.

So, if having us assist you with a commercial property acquisition is something you’d like more information about, please click the ‘Join the Waitlist’ button below.