Queensland’s Eight Top Property Investment Hotspots - Broken Down Into Four Price Brackets

- 18 min read

- May 31, 2024

- Jacob Butler, Troy Daly

This article will spill some secrets you won’t find on other websites.

It’s been specifically designed for property investors who want to take SWIFT advantage of Queensland’s property market – In a time when making money off property seems more impossible than ever. You may have heard the term ‘investment hotspots’ before. We know it sounds a bit ‘salesy’ and a bit melodramatic.

But here’s the thing.

Our experts have crunched the numbers from the Australian Bureau of Statistics (ABS), the big banks and reputable research houses.

And we can confidently state that we’ve come up with a solid list of eight areas that are the property investment hotspots to consider in Queensland today (early 2024).

And you can thank us later for this next bit – We’ve broken these regions down into four price brackets so you can quickly see if the areas fall within your price range.

If you’re a property investor who is looking for a new opportunity to grow your portfolio and secure a solid property before the market spikes, then you need to keep reading.

Before you dive in…

Grab our Must-Have Investor Index – The Ultimate Tool for Maximising Your Queensland Property Investments

Access it now and make smarter, data-driven investment decisions.

Queensland: The upcoming property boom of the 2020s and 2030s

Before you invest in any area, you have to look at the facts. And Queensland’s facts are enlightening. At the time of this writing, the Sunshine State is a melting pot for future property gains. Here’s why.

The Olympic Games

The Olympic Games are scheduled to be in Brisbane in 2032, and the Queensland property market is poised to experience a surge in demand. The Olympic Games are always massive crowd-drawing events. They won’t just bring significant infrastructure development to the city –

They will elevate Queensland’s global profile and drive tourism and investments.

How can we make this projection? A good start is by looking at past cities that have hosted the Olympic Games.

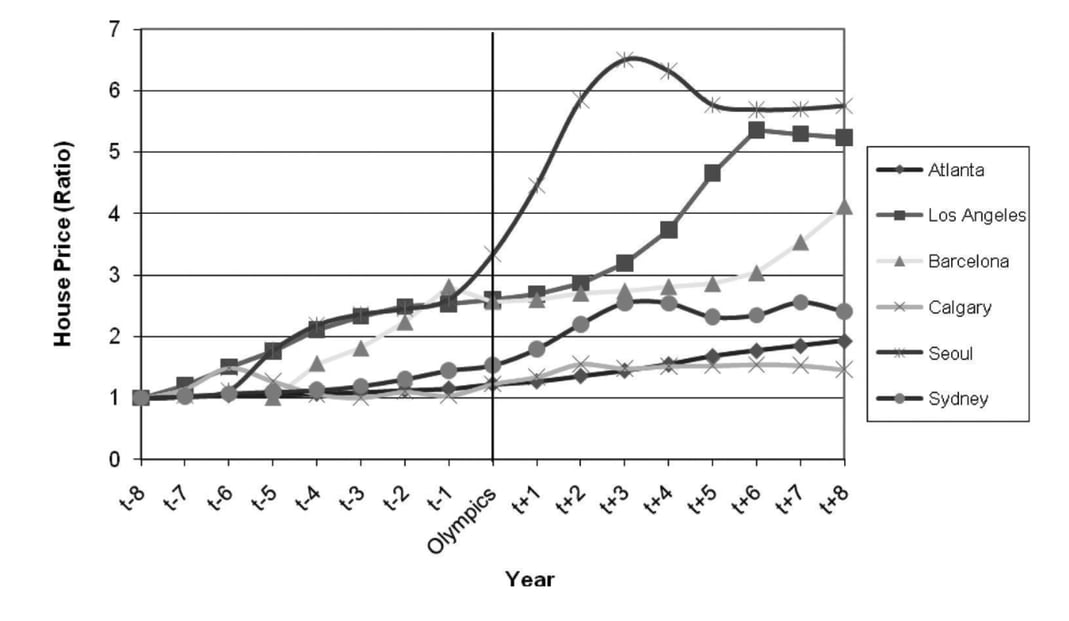

This graph from 2012 (published in Urban Studies) reveals a considerable increase in housing prices in six cities after the Olympic Games were announced, when the Games were hosted and in the years that followed.

The most impressive increases we’ve seen are in Los Angeles (1984), Calgary (1988), Barcelona (1992) and, of course, our very own Sydney (2000).

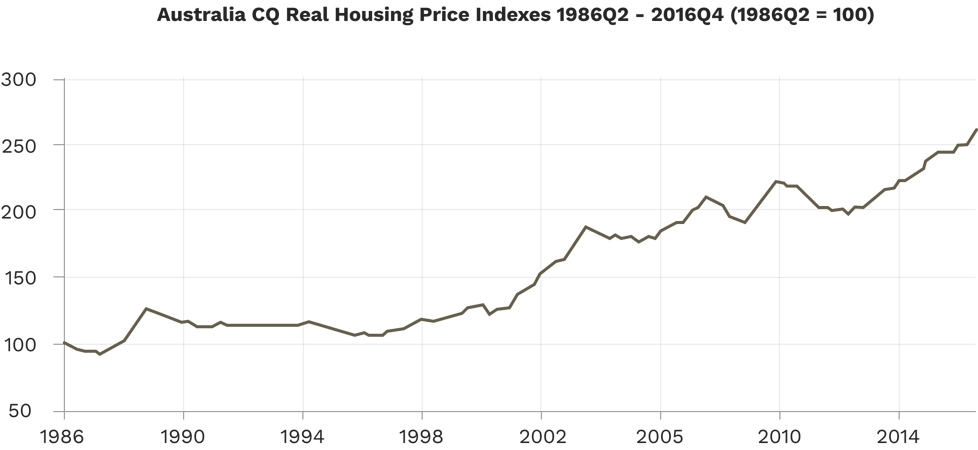

According to stats from CoreLogic, Sydney’s property values surged by 60% between 1993 (when the Games were announced) and 2000 (when the games were held). Stats from the ABS also illustrate the sharp increase in Sydney’s real housing price indexes after 2000.

Tip: We generally recommend looking for areas within Queensland that have a proven history of capital growth (regardless of the strategy you choose).

This graph from 2012 (published in Urban Studies) reveals a considerable increase in housing prices in six cities after the Olympic Games were announced, when the Games were hosted and in the years that followed.

The most impressive increases we’ve seen are in Los Angeles (1984), Calgary (1988), Barcelona (1992) and, of course, our very own Sydney (2000).

According to stats from CoreLogic, Sydney’s property values surged by 60% between 1993 (when the Games were announced) and 2000 (when the games were held). Stats from the ABS also illustrate the sharp increase in Sydney’s real housing price indexes after 2000.

It was estimated that the 2000 Olympic Games in Sydney injected $6 billion into the Australian economy.

But let’s put this into perspective. Westpac has predicted that the Olympic Games will generate around $8 billion to the Queensland economy alone.

Migration and population growth

Queensland’s population is growing.

Natural births

First, there’s going to be a natural increase in the number of people. Simply put, people are being born in Queensland faster than they are dying. Medical technology is superb. The health system is excellent. So the population is aging. The Queensland Government expects that they’ll see a natural population increase of around 261,000 people over the next 10 years.

Global migration

Second, people from all over the world are flocking to Queensland. Obviously, there was a dip when the borders closed during the COVID-19 pandemic. But that’s all history now. Over the next decade, international migration levels are expected to average 27,000 people per year.

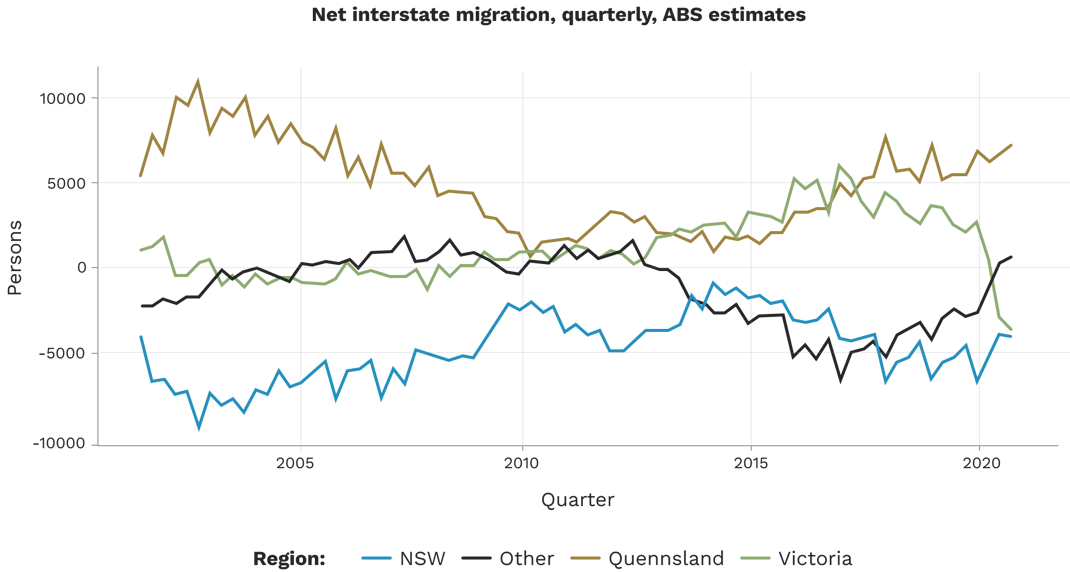

Interstate migration

Third, and most intriguingly, people are flocking from within Australia to live in Queensland. Australians are moving to the Sunshine State in ‘record numbers’ because housing is considerably more affordable in cities like Brisbane, compared with Sydney and Melbourne (currently, at least). We can see that Queensland’s net interstate migration dominated other states in recent years.

Within one year (ending in June 2021), Queensland enjoyed 90% of the net interstate migration (30,939 people). This is the highest that number has been since 2004. And over the next five years, the Property Council of Australia estimates that around 220,000 people will leave the rest of the country to move to Queensland. We expect that the increased need for homes will contribute to property prices that hit record highs.

Booming economy

Now more than ever, Queensland boasts a diverse and thriving economy. In fact, the Commonwealth Bank called it the ‘best performing state economy’ in 2023 for the first time. In September 2023, Steven Miles, Queensland’s Acting Premier and Minister for Infrastructure, said:

Queensland is booming. Our population is growing, we’re exporting more Queensland products to the world, we’re seeing increased investment in infrastructure and more money being spent in our state.

Supported by sectors such as tourism, agriculture, mining and education, Queensland has a rock-solid economic foundation that explains the state’s consistent growth for over 20 years.

This definitely makes it an attractive target for the savvy property investor.

In fact, Queensland’s property market was one of the few in Australia that actually thrived during the COVID-19 pandemic.

At the end of 2020, 52 out of 56 (93%) of the regional Local Government Areas recorded positive annual growth. That’s saying something.

Weather and lifestyle

They call it the Sunshine State for a reason.

(And it explains in part why people have been flocking there.)

Queensland is well known for its stunning natural landscapes, beautiful beaches and year-round sunshine.

Many see Queensland as the ‘chill’ state, compared with others (especially New South Wales, which is often seen as too ‘hustle and bustle’).

This is translating to tangible property growth.

Just look at the Wide Bay Region in Queensland – CoreLogic noted that property prices in Bundaberg, Hervey Bay and Maryborough all jumped 65–75% in the past five years.

Largely for one simple reason – those places are beautiful!

Queensland is booming. Our population is growing, we’re exporting more Queensland products to the world, we’re seeing increased investment in infrastructure and more money being spent in our state.

High income yields

The Queensland property market also offers attractive rental yields that we’ll explore in more detail later in this article. With the demand for rental properties on the rise, particularly in key urban centres like Brisbane and the Gold Coast, investors can capitalise on favourable rental market conditions that outshine other states.

Strong capital growth

When you’re deciding on an area to invest in, there’s no point choosing a place with good rental yields if the area is not going to experience good capital growth.

Historical data indicates that Queensland properties have demonstrated robust capital growth over time.

The hotspots we’ll explore in this article have all been carefully selected for their capital growth potential and because they are fuelled by major investment projects like the Olympics, lifestyle convenience and amenities.

And of course, as the population and economic growth continue to drive demand, property values are expected to go up. This provides investors like you with the potential for significant capital gains in the long term.

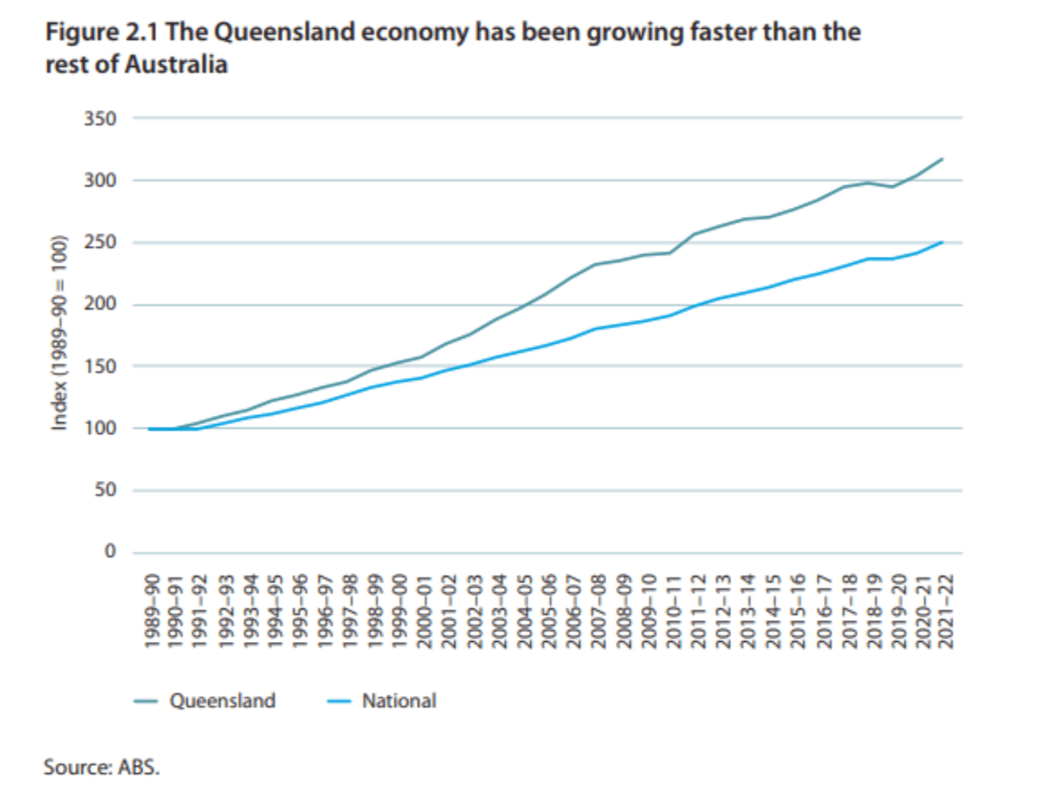

Queensland vs the rest of the states

When compared with the other states, Queensland’s economy is finally beginning to shine brighter than all the others.

In the 13-year history in CommSec’s State of the States report, Queensland came out on top in January 2023.

The state’s economic activity, population growth, robust job market and rock-solid energy sector are bearing fruit that investors should seriously consider taking advantage of.

(Preferably, before the massive boom we’ll have with the Olympics in 2032).

According to the ANZ 2023 report Queensland: Future State, Queensland is growing faster (2.2%) than the national average (1.6% year-on-year), and it consistently shines brighter than the other states.

The report projects that Queensland’s economy will increase by 31% over the decade leading up to 2032–33 if there are no significant changes and the economy remains ‘business as usual’.

However, if the state embraces new prospects that could lead to a more optimistic outlook, such as critical minerals, hydrogen and agtech, the state’s economy could increase by up to 46% by 2032–33.

What does this mean for property prices in Queensland vs other states?

It means that property investors should be seriously looking at Queensland.

The state is currently in a unique position.

It’s relatively affordable – and the strength of its core foundations means that we can expect a boom in the late 2020s and into the 2030s that is largely triggered by the anticipation of the Olympics.

We know that a growing economy, a booming job market and a desirable lifestyle are all factors that contribute to its appeal among property investors.

And Queensland has become a strategic choice for investors who are looking to diversify their portfolios and capitalise on emerging opportunities in property.

Before you dive in…

Grab our Must-Have Investor Index – The Ultimate Tool for Maximising Your Queensland Property Investments

Access it now and make smarter, data-driven investment decisions.

Your Queensland investment strategy

Okay, so you understand why Queensland is the place to invest. It’s outshining the rest of Australia right now, so it’s time for you to look for opportunities in the Sunshine State.

However…

If you’re serious about investing in property, you need a strategy. This is one of the most common mistakes made by property investors. They decide to buy one property, try for another – and then they get stuck.

The reason?

They never had a strategy or an endgame in mind.

Here’s the reality.

The area of Queensland that you choose, the type of property that you buy and how much you decide to spend should all be tailored to your strategy. Every savvy property investor knows this.

Here at Gather, there are generally three ways we like to think about approaching an investment strategy:

- High capital growth

- High income yield

- A balanced approach

Follow along as we explain these three types of strategies in more detail.

High capital growth

One of the most common investment strategies that we recommend is the high capital growth strategy that involves buying properties that are likely to increase in value over time.

‘Capital growth’ is just a fancy way to express how much your property increases in value.

How do you calculate capital growth?

All you have to do is compare the current market value of your property with how much you paid for it.

For example, if you bought a property for $300,000 and it’s now worth $1 million, you’ve achieved a capital growth of $700,000 on that property. Congrats!

What drives capital growth?

A few things.

The economy

If an economy is booming, the properties within it are more likely to enjoy strong capital growth over the years.

This doesn’t just mean the national or state economy; it means the local economy as well. There are plenty of suburbs in Queensland that suffer from slow growth, despite the booming areas around them.

The population

Population growth in an area will bring more jobs and more money into the economy.

Savvy investors won’t just look at the broad economic trends of the state. They’ll take it to a microscopic level to see whether a particular street in a particular area is going to increase in population.

Supply and demand

You’ll find that areas with strong capital growth are areas that have limited supply where there are tight restrictions around development and where areas are landlocked.

If demand is high and supply is low, you’ll be much more likely to enjoy an increase in capital growth.

Tip: We generally recommend looking for areas within Queensland that have a proven history of capital growth (regardless of the strategy you choose).

High income yield

Another common investment strategy that many adopt is the high-income yield strategy, which means that you focus on ensuring that your properties generate high returns on your investment.

The key difference between a high-income yield strategy and a capital investment strategy is that capital growth focuses on a long-term investment while rental yield focuses on obtaining immediate income.

The strategy that works for you will depend on your circumstances, your risk portfolio and your long-term goals.

There are two types of yield: gross rental yield and net rental yield.

- Gross yield is how much rent you earn before expenses.

- Net yield is how much rent you earn after expenses.

3 steps to calculate a gross rental yield:

- Calculate your total annual rent

- Divide that figure by the value of your property

- Multiply the answer ×100

You’ll get your rental yield as a percentage.

Say you purchase a property for $950,000.

The weekly rent is $500.

If you multiply the weekly rent by 52, the answer is $26,000 (your annual rent).

Your gross rental yield, multiplying it by 100, is 2.74%.

5 steps to calculate a net rental yield:

- Calculate your total annual property fees and expenses

- Calculate your total annual rent

- Subtract the fees and expenses from the rental income

- Divide that figure by the property’s value

- Multiply the answer ×100

Using the example above, let’s hypothetically say that you have $4,000 in annual property expenses.

Your net rental yield = ($26,000 in rent - $4,000 in expenses) ×100

Your net rental yield is 2.32%.

How do you create a high-income yield?

To improve your rental yield, you’ll need to:

Buy in a terrific location

It’s often the case that when you buy in an area with high demand (which sometimes means investing in a place with high capital growth), you’ll increase the chances of having a high rental yield.

Choose the correct property

You should avoid simply picking a suburb that is generally known to have good rental yields. You’ll need to do your homework and select the best property on one of the best streets in the best slice of the neighbourhood in order to really maximise those yields.

Refresh or renovate

Making renovations, no matter how small or how large, can help you increase the amount of rent that you charge your tenants. This could really be anything from changing the cabinet handles to remodelling the entire kitchen.

Accept pets (strange)

People are willing to pay more money for a place that allows them to bring their pets. They understand that pets make messes, and that you may need to charge more to cover cleaning and maintenance costs. Use that to your advantage.

Balanced (i.e. a healthy mix of the above)

A balanced property strategy means executing a good mix of the above – i.e. buying a property in an area with strong capital growth and then refreshing/renovating it to maximise rental yield.

This may involve:

- Buying a ‘fixer upper’ in an otherwise booming suburb and completely renovating it to increase rental yield.

- Buying a house on a large parcel of land within a region with a growing population and building a granny flat to create a dual income stream.

- Buying a house on a quiet, family friendly street in an area with a strong local economy, adding solar panels to reduce electricity bills and renovating the front to increase curb-appeal.

As a general rule of thumb, we recommend against buying apartments, simply because there is not that much you can do to improve the rental yield. Your potential is also limited by the rules of strata.

And the value of land tends to appreciate over time while dwellings depreciate.

The four investor price points

Now that you have an understanding of the different types of property investment strategies, it’s time to hit you with a dose of reality.

Properties are expensive – and you should try to stay within your budget as much as possible.

We often see a key mistake made by new or inexperienced investors.

In a rush to buy property, they end up overpaying – in other words, they pay more than the property is worth.

This ends up working against them, as any benefits they obtain from rental yields are overshadowed by mortgage payments and other expenses.

Sadly, the investors end up creating very little equity in their property because the market has to catch up with the amount that they paid for it.

And even worse, if the market decreases, they can be pushed into negative equity territory.

There are four ‘investor price points’ that you should keep in mind:

Investor price points

Markets below $500,000

Markets below $600,000

Markets below $800,000

Markets below $1 million

If you’re serious about purchasing a property in Queensland, then you’ll need to look for areas that fall within your price point.

If you buy above your price point, there is a considerable risk that any strategy you execute will yield poor results because you have overpaid for a property

Before you dive in…

Grab our Must-Have Investor Index – The Ultimate Tool for Maximising Your Queensland Property Investments

Access it now and make smarter, data-driven investment decisions.

The eight key Queensland property investment hotspots (broken into four price brackets)

Now that you know each of the price points, let’s get into the hotspots.

Our team of analysts have studied Queensland in depth, crunched the numbers and concluded that there are currently eight Queensland hotspots you need to know about if you’re serious about investing.

These eight key property investment hotspots in Queensland have been broken down by the four investor price points highlighted above.

Properties below $500,000

If your budget is below $500,000, there are three areas to look at in Queensland.

Townsville

Typical property price: $415,000

Median rent: $437 per week

Rental yield: 5.48%

Historical capital growth: 44.6% (over the last five years)

Vacancy rate: 1.04%

Townsville is the hidden gem for property investors on a budget.

- There is a consistent strong rental demand in the area.

- Townsville enjoys a growing population – people are constantly relocating to Townsville City.

- Townsville is experiencing strong capital growth potential, with considerable development in its infrastructure, new roads, hospitals and schools.

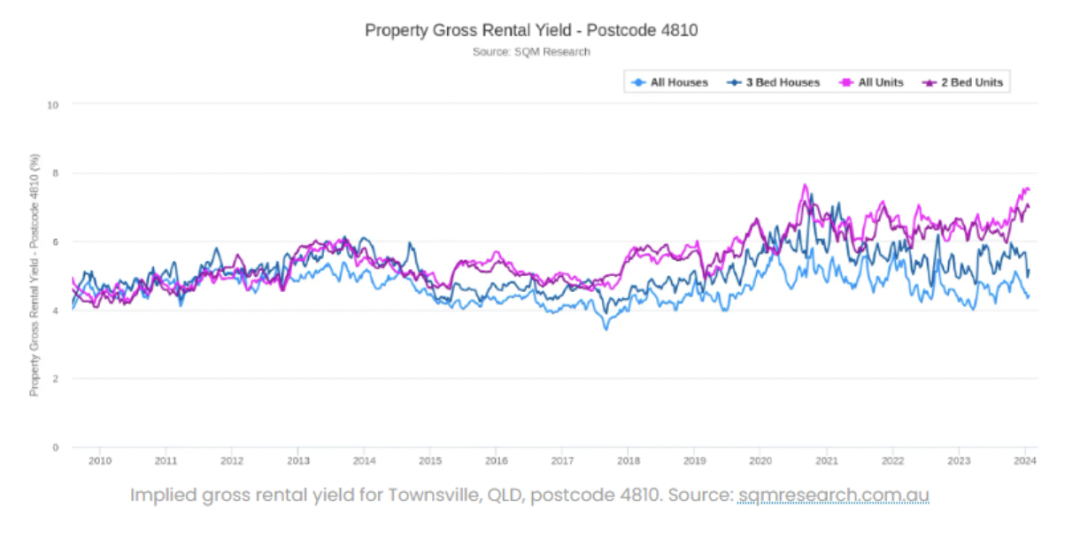

- Townsville City (postcode 4810) is experiencing strong rental yields, especially two-bedroom units, as can be seen in the following graph.

Bundaberg

Typical property price: $500,000

Median rent: $470 per week

Rental yield: 4.89%

Historical capital growth: 83% (over the last five years)

Vacancy rate: [0.70%]

Known for Bundaberg Rum, Bundaberg is a coastal city that is popular among investors, especially if they’re on a budget.

- For the past few years, Bundaberg has been attractive for two primary reasons: it’s affordable to live there, and it has a terrific, laidback lifestyle.

- The region is known for its tight rental market and considerable yields – it’s sometimes referred to as having a ‘trifecta of growth, yield and rising rents’.

- The low vacancy rates ([0.70%]) are a testament to the area’s high demand and low supply.

- It’s historically had a great track record for growth – Bundaberg South (a suburb of Bundaberg) experiences an annual capital growth of 4.59%.

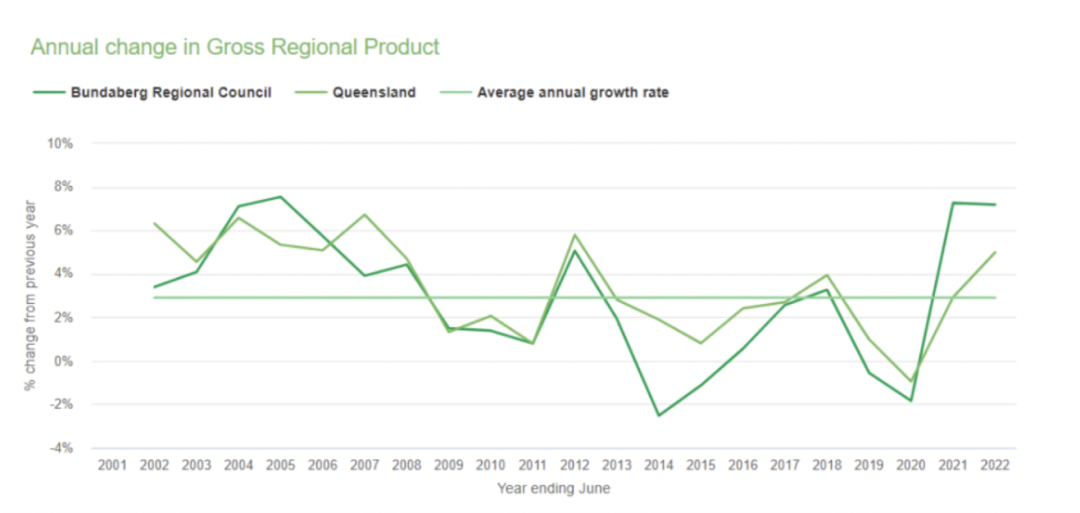

- Bundaberg is growing faster than the state – in 2022, it grew by 7.2%, compared with the 5% state average, as can be seen in the following graph:

Rockhampton

Typical property price: $398,330

Median rent: $438 per week

Rental yield: 5.72%

Historical capital growth: 56% (over the last five years)

Vacancy rate: 1.03%

Rockhampton is a region that contains one of the oldest cities in Queensland, and that has investors talking because of how fast the area has grown.

- Rockhampton is a growing region that is still affordable; it has loads of opportunities to invest on a low budget.

- Plenty of people are flocking to live there. In 2023, there were over 83,000 inhabitants, and the population is expected to rise by 17.22% by 2041.

- There’s a strong job market in Rockhampton and a robust economy that was worth $5.71 billion in 2022.

- Rockhampton Council’s Economic Development Strategy and Action Plan aims to drive growth in the area over the next five years. It looks to boost everything from infrastructure and attracting investments to regional partnerships and talent retention.

Properties below $600,000

If you can spend just a little more, you’ll want to look at investing in either Cairns or Toowoomba.

They are two areas in Queensland that have enjoyed considerable capital growth in recent years, and they are the current investment hotspots for investors at a price point below $600K.

We’ll get into the details below.

Cairns

Typical property price: $557,000

Median rent: $540 per week

Rental yield: 5.04%

Historical capital growth: 48.9% (over the last five years)

Vacancy rate: 0.60%

Cairns has earned the reputation of being a tropical paradise; its beautiful beaches, gorgeous weather and attractive lifestyle attract both tourists and residents.

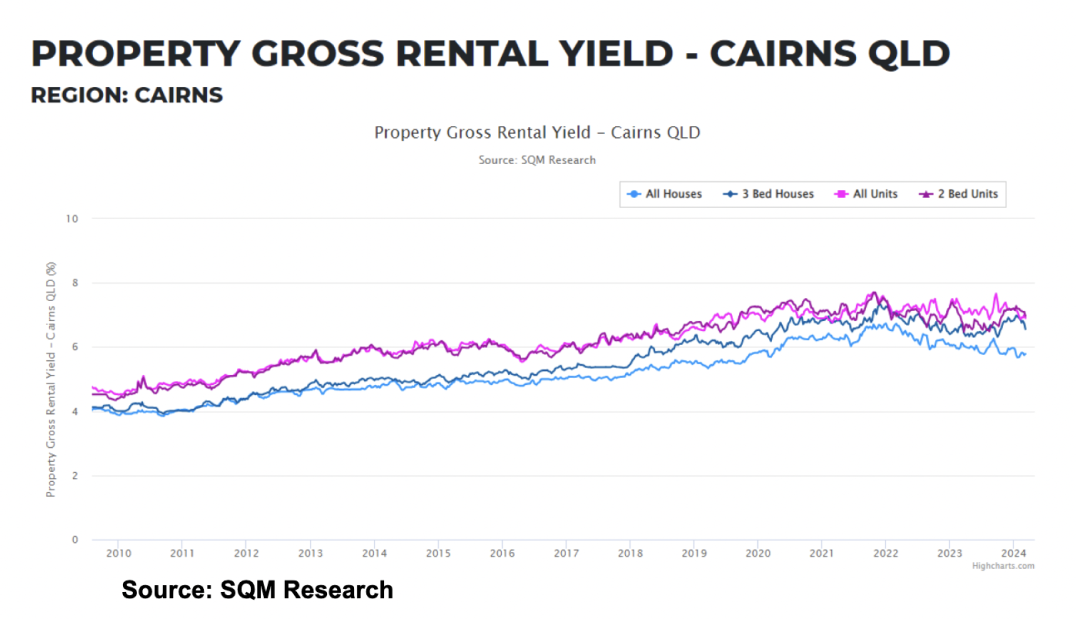

- According to SQM Research, Cairns has the highest unit gross rental yields in Australia (2023), followed by Brisbane and Sydney, and it has suburbs like Bungalow that shine above the rest.

- Cairns has a robust economy that is largely driven by industries like tourism. This is unsurprising, given that it’s a gateway to the Great Barrier Reef.

- The temperatures range from 17 to 31 degrees Celsius and create a tropical lifestyle that its residents love.

- It’s a fast-growing city that boasts over 160,000 people, and the population is expected to grow by 2% every year.

- The rental yields in Cairns are strong due to the limited supply of properties and the high demand for accommodations, as illustrated below.

Toowoomba

Typical property price: $543,000

Median rent: $437 per week

Rental yield: 4.18%

Historical capital growth: 65% (over the last five years)

Vacancy rate: 1.05%

Toowoomba is fast becoming a red-hot property investment, not just in Queensland, but in all of Australia.

- Toowoomba is an expanding city that is located near the Surat Basin, and it is only a few hours’ drive west of Brisbane.

- Consistent billion-dollar investments are being made in Toowoomba (development projects received $18.8 billion in investments over an 18-month period in 2023), including the Toowoomba North–South Transport Corridor, the Inland Rail, the Toowoomba Hospital and the Toowoomba to Warwick pipeline.

- The Toowoomba Council adopted its largest ever budget in 2023-2024 ($651 million) with the aim of upgrading services and facilities and planning for the future.

- The city enjoys a low housing supply and low rental vacancies but has a sharp demand for property due to its buzzing economic activity and growing population (which increased by 1.4% each year from 2017 to 2022).

- Toowoomba experienced home price increases by just over 52% over the past five years, compared with 58% for regional Queensland (PropTrack, 2023)

- Toowoomba continued to grow despite rising interest rates (which highlights the incredible potential of investments in regional Queensland).

Properties below $800,000

We’re starting to climb up the ladder now. If your budget is under $800,000 (but more than $600,000), you’re going to want to look at one place, and one place only – Brisbane.

Brisbane

Typical property price: $976,000

Median rent: $617 per week

Rental yield: 3.28%

Historical capital growth: 57.4% (over the last five years)

Vacancy rate: 1.04%

Investing in Brisbane is exciting, given that it’s one of the fast-growing cities in the country.

- The Brisbane Olympics are less than a decade away, and investors are scrambling to discover the best spots in the city so they can reap the rewards.

- There has been massive population growth due to international and interstate migration. The 2023 ABS statistics show that it is the fastest-growing capital city in the country (an additional 59,000 people in 2021–22).

- It is still affordable, compared with the rest of the eastern seaboard. The median house price in Brisbane is currently $899,474 – considerably lower than the prices in other capital cities such as Sydney (median house price of $1,395,804).

- The housing supply is limited, and the Queensland Government Statistician’s Office indicated in September 2023 that building approvals were approaching their lowest levels in 20 years.

- There is a strong rental market in Brisbane that translates to reliable income. Over the past few years, we’ve watched as the Brisbane rental market has enjoyed a 13.4% increase in median weekly rents every year.

Before you dive in…

Grab our Must-Have Investor Index – The Ultimate Tool for Maximising Your Queensland Property Investments

Access it now and make smarter, data-driven investment decisions.

Properties below $1 million

If your budget falls between $800,000 and $1 million, then you can still look at Brisbane.

But why do that when you can take advantage of two more investment hotspots in Queensland?

Introducing the Gold Coast and the Sunshine Coast.

Gold Coast

Typical property price: $1,030,000

Median rent: $752 per week

Rental yield: 3.79%

Historical capital growth: 62.9% (over the last five years)

Vacancy rate: 1.10%

The Gold Coast is known as being one of the most enjoyable places to visit across Australia. But going behind the glitz and the glamour, the numbers that show that the Gold Coast has a promising investment do not lie:

- The Gold Coast economy is incredibly vibrant, with a growing population of more than 630,000 people and a position as Australia’s sixth largest city.

- The population continues to grow and is expected to reach 1 million people by 2046 (Queensland Government Statistician’s Office, 2021).

- The Queensland Government is investing over a billion dollars into the Gold Coast economy. Mayor Tom Tate said that the Gold Coast, federal and state governments plan to spend over $3 billion on the Gold Coast economy.

- The Government is working on upgrades to the Pacific motorway (M1), upgrades to the Gold Coast Light Rail and construction of a new rail facility at Ormeau.

- The Gold Coast is experiencing a shortage of dwellings combined with a highly desirable lifestyle, meaning that prices are increasing.

Sunshine Coast

Typical property price: $908,000

Median rent: $667 per week

Rental yield: 3.81%

Historical capital growth: 60% (over the last five years)

Vacancy rate: 0.94%

The beautiful Sunshine Coast is the other area to keep your eye on if you’re able to spend up to $1 million.

- Unlike the Gold Coast (which largely relies on tourism), the Sunshine Coast enjoys a diversified economy, with tourism, retail and construction proving to be strong industries.

- We’re seeing considerable infrastructure investment in the area, including a new health precinct at Birtinya (expected to contribute $3.2 billion to the Sunshine Coast economy).

- The Sunshine Coast is well known for its fabulous lifestyle; its gorgeous hinterland, pristine beaches and perfect climate make it a highly attractive location for tourists and residents.

There’s also a strong rental market with low vacancy rates that results in higher yields if you’re a property investor.

Time to make the move (read this first, though).

Buying any investment property is exciting and rewarding when it’s done right.

But if you’re not an experienced investor (or if Queensland is a market you’re not entirely familiar with), then it’s risky to make the move alone.

The market is difficult to navigate, there’s a lot that can go wrong and the consequences can be disastrous if you pick the wrong location or rely on bad data.

But it doesn’t have to be that difficult or overwhelming.

With Gather, the journey of property investment in Queensland is seamless, easy and straightforward.

We use data analytics and our unique access to off-market opportunities in the Queensland market to help investors find (and buy) the perfect properties.

Ready to make the move in Queensland?

Our buyers’ agents are here to help you every step of the way.

Our team is ready to help you crunch the numbers, work out your goals and figure out where you want your portfolio to take you.

There’s no need to buy your first (or next) property in Queensland on your own.

We look forward to hearing from you!

Join the waitlist